Bitcoin has a dirty secret, and the community rapidly running out of excuses for it.

When Satoshi Nakamoto created the digital currency Bitcoin, he also decided there would never be more than 21 million coins. These coins would slowly be released over time, as a reward for those participating in the block creation process for Bitcoin’s underlying blockchain. Satoshi described the “steady addition of a constant of amount of new coins” as “analogous to gold miners expending resources to add gold to circulation”, and noted that “in our case, it is CPU time and electricity that is expended”.

Growing energy consumption

It is unknown whether Satoshi, while writing this, ever envisioned the energy-hungry nightmare Bitcoin has become. Over the full year of 2018, Bitcoin miners were responsible for a total electrical energy consumption of at least 40 terawatt-hours (TWh). This is equal to the amount of electricity consumed in a country like Hungary, and 20 percent of the total amount of electricity consumed by data centers worldwide (200 TWh per year). The latter number includes the electrical energy consumed by data centers responsible for processing transactions of the global banking industry. It is unknown what part is used for banking exactly, but even if we attribute everything to the banking industry, extreme differences in operating scale ensure that Bitcoin isn’t looking good in comparison.

The global banking industry processes around 500 billion of non-cash transactions per year. With a total energy requirement of 200 TWh, that results in an maximum energy footprint per transaction of 400 watt-hours (Wh). This would be an extreme number given that a single VISA transaction has an energy footprint of ~1–2 watt-hours (VISA as a whole only requires 0.20 TWh per year, and its data centers make up for half of that amount). At the same time, Bitcoin processed only 81.4 million transactions in 2018. This puts the minimum energy footprint of a Bitcoin transaction at 491.4 kilowatt-hours (kWh), more than 1,200 times the maximum footprint of a traditional non-cash transaction, and more than 250,000 times the footprint of a VISA transaction.

This utterly disastrous performance should be no surprise. Every second of the day, the Bitcoin network is running through 45 quintillion (45 * 10^18) hash operations. This is part of the process for creating new blocks of transactions for Bitcoin’s blockchain. With 81.4 million transactions per year the amount of transactions processed every second is, however, only 2.58. That’s a ratio of more than 17 quintillion to one.

The energy going into the network isn’t “green”

Bitcoin proponents have subsequently started to argue that, even though the network might require a huge amount of electricity, the environmental impact of this is limited. According to them, the network utilises excesses of renewable energy, mostly in the province of Sichuan in China, that would otherwise go to waste anyway. As a result, the environmental impact of Bitcoin mining would be negligible. Regardless of whether this is true or not (no serious support is being provided), the claim wouldn’t hold true even if most miners were indeed located in Sichuan.

Part of the story that Bitcoin’s proponents won’t tell is that the production of hydroelectricity in Sichuan is extremely volatile, and excesses are therefore temporary at best. During the wet summer months the production is three times higher than in the dry winter months. This is a problem that concerns renewable energy in general. The sun isn’t always shining, the wind isn’t always blowing, and droughts limit the availability of hydropower. Renewable energy production is volatile by nature.

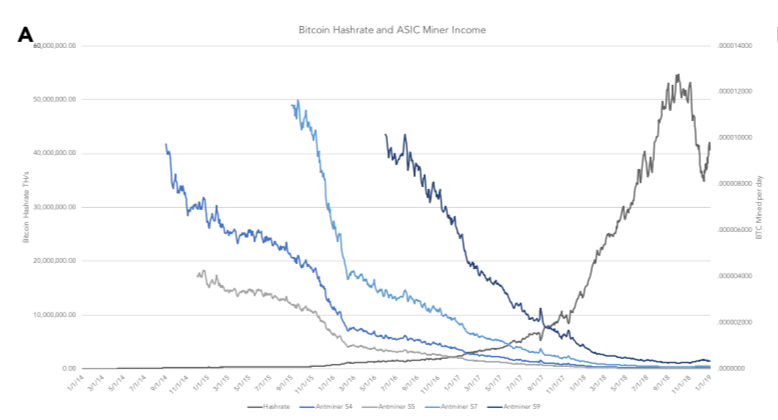

At the same time, a Bitcoin miner will always have a constant year-round demand. A Bitcoin mining device, once switched on, will not be shut down until it either breaks down or becomes unprofitable. A miner simply cannot afford to shut down, as new machines are constantly being added to the network. This quickly dilutes the income a mining device can generate (as the fixed block rewards have to be shared among more machines). Shutting down, even for a brief period of time, results in an unrecoverable loss of income.

This makes renewable energy production and Bitcoin energy demand fundamentally incompatible. In Sichuan, the fluctuations in hydroelectricity production are usually balanced out with coal-based energy. In fact, new coal-based power plants are still being constructed to this purpose, and the presence of Bitcoin miners will only be an extra incentive for this (or for keeping existing ones open). Sichuan cannot import cleaner electricity from more remote locations due to poor grid infrastructure; the same reason why the temporary excesses of hydroelectricity exist in the first place (as there’s no proper export capacity).

It should be no surprise that the carbon intensity of purchased electricity in Sichuan is much higher than, for example, in Sweden (where generated power is generally nuclear or hydroelectric). The emission factor of electricity generated in Sweden is at around 13 grams of CO2 per kWh, the emission factor of purchased electricity in Sichuan is at least 265 grams of CO2 per kWh. Hence the renewable energy going into the Bitcoin mining network cannot be considered “green” either. If all Bitcoin miners would be located in Sichuan, Bitcoin’s minimum energy footprint of 491 kWh per transaction would still translate to a carbon footprint of 130 kilograms of CO2 at the very least. That’s equal to the carbon footprint of driving 500 miles in a Tesla model S, or consuming almost 5 kilos of beef. Per transaction. In the most optimistic scenario. By comparison, a Google search only equates to 0.8 grams of CO2, and a VISA transaction to 0.4 grams. Have you ever tried eating ~0.015 grams of beef?

No amount of “green” energy can solve for electronic waste

The other thing Bitcoin’s proponents are turning a blind eye to is that, no matter how “green” the energy going into Bitcoin mining, the network still has an ugly electronic waste footprint. The machines used for Bitcoin mining are mostly Application-Specific Integrated Circuit (ASIC) miners. As implied by the name, they are hardwired for a singular purpose and thus cannot be repurposed after their useful lifetime. Like most electronic waste (globally only 20% is recycled), they will end up on environmentally damaging landfills and incinerators afterwards. The whole Bitcoin network produces as much electronic waste as a country like Luxembourg, and each unique Bitcoin transaction carries an electronic waste footprint of a staggering 135 grams (equal to four standard sixty-watt light bulbs). That’s at least 30,000 times greater than a very pessimistic estimate for the electronic waste footprint of a VISA transaction (assuming each VISA server weighs 100 kilograms and gets replaced every year). No amount of “green” energy will solve this.

It’s time for a change

There’s no way to put a positive spin on this. One could only argue that developments like the so-called Lightning Network (a second layer solution for scaling Bitcoin) may assist in reducing the environmental footprint per transaction, but this will certainly not be case in the near future (if at any point at all). A recent “proof of concept” on the Lightning Network, Lightning Pizza, can only be considered a failure. Only ten percent of the orders placed on the first day were successful, the other ninety percent failed. These numbers will have to turn around if this is to be taken seriously as a payment system. But even if the Lightning Network magically started to work properly, a reduction in the environmental footprint per transaction is not a foregone conclusion. Increasing use of lightning transactions should correlate with an increase in both Bitcoin adoption and the value of Bitcoin, and therefore with increasing capital and energy expenses by miners. Only a 100,000% improvement of the current network throughput, without any material increase in the value of Bitcoin, would be a good start to bringing the footprint per transaction back to an acceptable level.

Another argument, that Bitcoin’s mining mechanism offers unmatched security, is simply false. Mining-based cryptocurrencies have been plagued by majority attacks over the last year, including successful double spends on Bitcoin Gold and Ethereum Classic. In Bitcoin itself the supposedly superior security mechanism could not prevent CVE-2018–17144, a critical bug that could have allowed a Bitcoin miner to inflate the Bitcoin supply. As the bug made its way into the code due to a lack of proper testing, it showcases that even a multi-billion-dollar currency, secured by an extremely energy-hungry network, can still have an amateur hour moment in its development. Perfect security does not exist. Lastly, it’s also unclear if Bitcoin’s mining mechanism could sustain itself long-term. A report by the Bank of International Settlements described significant economic problems in Bitcoin’s design. Falling miner income would cause “liquidity to fall dramatically”, and as a result it “could take months before a Bitcoin payment is final”. The solution for the latter would be to switch the confirmation process to the Proof-of-Stake protocol.

The same switch would also be required to solve for Bitcoin’s environmental impact. Proof-of-Stake does not depend on computational power, hence there is no incentive to spend extreme amounts of electricity or develop specialised (single purpose) hardware. Alternatives like these, currently used by various cryptocurrencies already, show that blockchain technology can be “green” even in the public domain (private blockchains generally don’t make use of mining at all, so the environmental impact isn’t a concern for these). The Bitcoin community only has to follow the example already set by others. Until then, there’s no escape from the currency’s disastrous environmental performance.

This article was featured on Hackernoon.

Hmm, how much energy do the economic system use? And the internet and all devices on it use? Then when you know that you can start to considder if bitcoin is actually using. Wast energy will go down in all systems as technology is evolving. Renewable and carbon nutaral energy wil solve that problem with all systems, no matter how you put it. If it no actual waste output other then green energy what is the harm? If you think the cheepest energy is actually dirty you are soly mistaken. In china the cheepest energy is hydrodams. They overproduce energy so much that they would pay you to use the peek energy output. If a miner comes along it balance market out and make the dam more profitable and no or less energy goes to waste. You need to research way more. Also buy some bitcoin and enjoi a 100x + up in long term instead of spreading nonsense.

It’s time for a change!

First

The energy going into the network isn’t “green”

Then

No amount of “green” energy can solve for electronic waste

Contradicting yourself in the same article.

Please people don’t waste your time, this guys is paid to shill bitcoin “energy problem”. When it’s the most green industry.

Please do yourself a favor a read a piece which is real journalism about this issue if it matters to you (that I agree we should care about it):

https://medium.com/coinshares/beware-of-lazy-research-c828c900b7d5

But please leave away from this site as it if were cholera (which it is).

Hi Paul,

Please explain the contradiction? The energy going into the network cannot be considered “green”, and on top of that the network has an electronic waste problem. If there’s a contradiction there then I don’t see it.

In the meanwhile you make random baseless accusations, while referring to Coinshares as a prime example of “real research” contrary to what is produced by academics. What I find most amusing about this “lazy research” piece is that Coinshares in its own research refers to sources that show how Bitcoin promotes the use of stranded coal (rather than renewables). The irony is pretty strong here.

I lost $50,000 to banc de binary because I was gullible enough to fall for their tricky scam and techniques. I was convinced to trade with them and not having issues in getting my withdrawal done but to my surprise they wouldn’t let me make withdrawal after taking $50,000 from me I wouldn’t blame them I blame myself for being too gullible to fall for their tricks. After several months of trying to get my money I fortunately came across contact@alliedrecovery@gmail . Org or WhatsApp: +1 (425) 312-1045, a recovery expert and I was able to get back my whole money in full through him at least 96% of my money was recovered back.

Have you gotten yourself involved in a cryptocurrency scam or any scam at all? If yes, know that you are not alone, there are a lot of people in this same situation. I was a victim of a cryptocurrency scam that cost me a lot of money. This happened a few weeks ago, there’s only one solution which is to talk to the right people, if you don’t do this you will end up being really depressed. I was really devastated until I was referred to a recovery expert. Less than 2 weeks, he has already recovered 85% of my loss: jimfundsrecovery at consultant dot com. Very Grateful.

si se ha involucrado en una estafa de criptomonedas o en cualquier estafa. Sepa que no está solo, hay mucha gente en esta misma situación. Fui víctima de una estafa de criptomonedas que me costó mucho dinero. Esto sucedió hace unas semanas, solo hay una solución que es hablar con las personas adecuadas, si no lo haces terminarás muy deprimido. Estaba realmente devastado hasta que me remitieron a un experto en recuperación. En menos de 2 semanas, ya recuperó el 85% de mi pérdida: jimfundsrecovery at consultant dot com. Muy agradecida.

I was surfing the net and luckily came across this site and found some very interesting stuff here

Students cannot spend much when it comes to seeking essay writing services

Hi, Great Post! Bitcoin has a dirty secret, and the community rapidly running out of excuses for it. When Satoshi Nakamoto created the digital currency Bitcoin, he also decided there would never be more than 21 million coins

Well done. I ma first time here. You way of communication is awesome. Bitcoin is, in fact, far further from death than it was all the (many) other times its demise was gleefully, and wrongfully, proclaimed. (Hearn’s central argument boils down to: “Bitcoin is failing because it has grown too popular!” Uh-huh. “Nobody goes there any more, it’s too busy.”)

Truly, this article is really one of the very best in the history of articles. I am a antique and I sometimes read some new articles if I find them interesting. And I found this one pretty fascinating and it should go into my collection.

Thank you for sharing this great post, I am very impressed with your post, the information given is detailed and easy to understand. I will follow your next post often.

Hey, my wife and I needed our credit repaired, so we contacted various credit companies all to no avail, I only moved up 20 points in almost a year and 6 months, about a month ago a friend of mine raised his credit from 591 to 788 in less than 9days. I asked him for guidance and he introduced me to ROOTKITS CREDIT SPECIALIST. He helped me remove all the negative items on my report, increased my score to 794 from the initial 612 and also gave me guidelines to maintain my excellent score. Contact them via (Rootkitscreditspecialist (at) gmail (dot) com) for any credit related issues. You can also contact them for crypto recovery, reliable investments of crypto and partnership in crypto mining.

Thanks for your information, it was really very helpfull.

The energy going into the network isn’t “green”

Then

No amount of “green” energy can solve electronic waste

Contradicting yourself in the same article.

I love this idea! It’s really amazing.Absolutely…very helpful and clear to understand. Brilliant, concise, thank you so much.

This is a warning to all bitcoin investors, Don’t be a victim. Most investment, forex/binary options companies out there are fraudulent. They are all scams. I have been a victim of their activities. I invested about 14btc and when i wanted to withdraw after some weeks, I was unable to reach their contact numbers or emails with which we stayed in touch. I assumed they were having some maintenance routing check, as that had happened in the past. After some weeks, I was contacted again by them and was asked to invest which i refused and told them i wanted to withdraw my money. After this, i didn’t hear from them again. At this point, I started to feel like i had been duped so I talked to my friend and he told me about a firm which specializes on helping get money back, the recovery agency IWT.BEST, they had helped a friend from his work some months earlier and did good. I contacted them, filed a complaint with them and they got back my money, all of it. They are 100% recommended if you find yourself in a similar situation